{{BlogData.Previous_Heading}}

{{BlogData.Previous_Date}}

Webinar On - {{item.WebinarName}} {{item.Date}} Book Now

{{BlogData.author}}

{{BlogData.Date}}

{{BlogData.readtime}} mins read

Difference Between Buying a Put Vs Selling a Call OptionOptions trading is a decent alternative to stock trading for beginners despite its complexities. Margin accounts, knowledge of risks, and how options work are prerequisites for trading in options. However, most traders are uncertain about the call and put options. The important thing to remember is that both of these are bearish strategies, and the primary distinction between them is that buying a put is equivalent to buying the market while selling a call is equivalent to selling the market. The underlying risk of purchasing an option is negligible and inversely proportional to the premium, but the potential reward is limitless. If you sell an option, your profit is restricted to the premium, and the loss is unlimited.

Explaining Call and Put OptionOne should be aware that the call and put option is bought and sold utilising contracts. Purchasing an options contract grants the right but never the obligation to buy or sell an underlying asset. In addition, you have a predetermined price to buy or sell that can be completed in accordance with the contract's conditions on or before a particular date. The right to acquire a stock is granted to the bearer of a call option, whilst the right to sell any stock is granted to the holder of a put option. Call and Put OptionA call option is a stock-related contract. A premium is a cost you pay for the contract. You then have the option to purchase the shares at the strike price at any time up until the contract's expiration date. You may not exercise the option. You can execute it or sell the contract itself for a profit if the stock price rises sufficiently. You can let the contract expire and just lose the premium you paid if it doesn't.

A put option is a stock-related contract. The contract entitles you to sell the stock at the strike price, is purchased for a premium. Until the contract's expiration date, you can sign it at any time. You can sell your put option for a profit if the stock price falls significantly. Since you are not required to carry out the contract, you are free to let it expire if the asset's value doesn't decrease sufficiently. Difference Between Call and Put Option:You purchase the right to purchase shares at the strike price specified in the contract when you purchase a call option. Ideally, the stock price will increase beyond the option's strike price.

The buying call and put option allows you to buy at a strike price and to sell at a strike price respectively. Both provide protection, leverage, and the possibility for greater earnings to option traders when employed appropriately. |

( Stay a while and read more interesting posts like this )

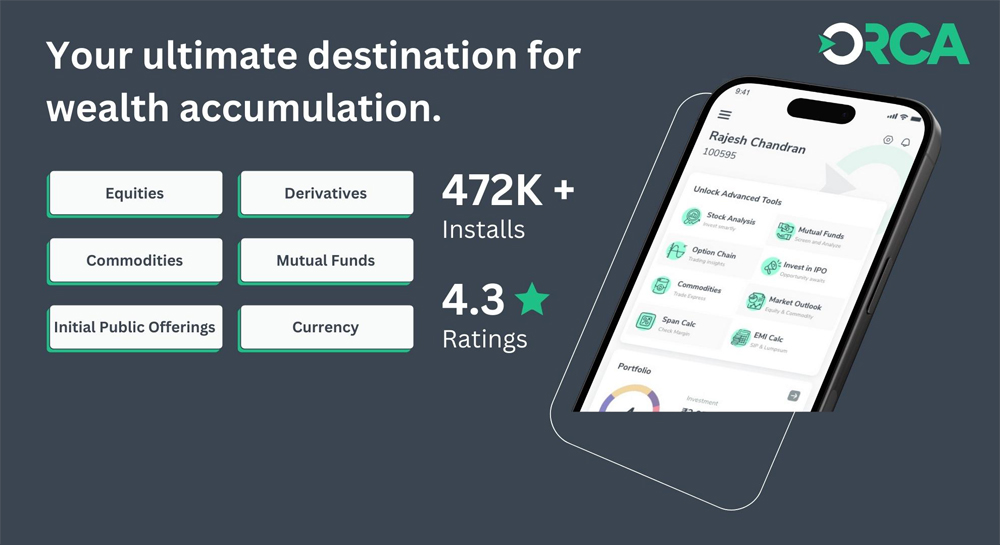

Sign up for Enrich Money and make an investment

{{item.CategoryName}}

({{item.CategoryCount}})

{{Recent[0].Recent_Heading1}}

{{Recent[0].Recent_Heading2}}

{{Recent[0].Recent_Heading3}}

{{Recent[0].Recent_Heading4}}

{{Recent[0].Recent_Heading5}}

{{news[0].News_Heading1}}

{{news[0].News_Heading2}}

{{news[0].News_Heading3}}

{{news[0].News_Heading4}}

{{news[0].News_Heading5}}