Webinar On - {{item.WebinarName}} {{item.Date}} Book Now

Open Free Demat Account in Just 10 Minutes!

Maximize Your Trades With Our Minimal Charges

₹0

Zero Brokerage for Equity Delivery

₹20

Equity,Commodity,F&O & Currency

₹0

Account Maintenance for First year

Stay ahead in the markets with ORCA

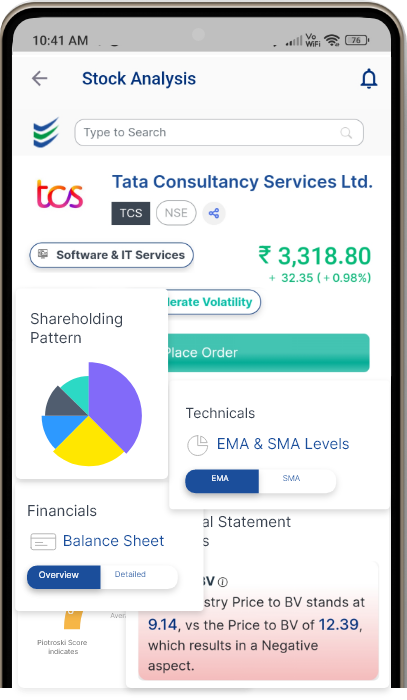

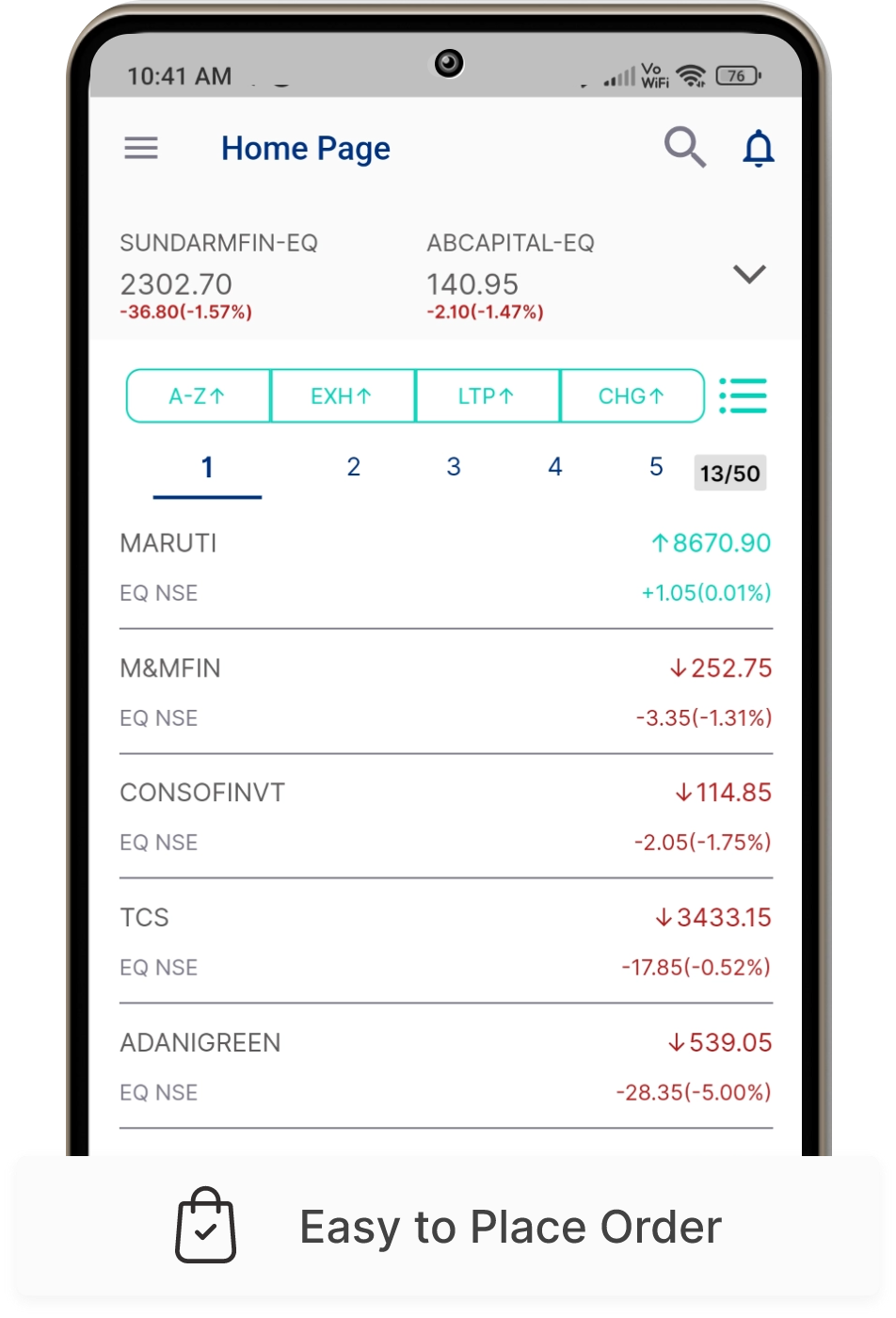

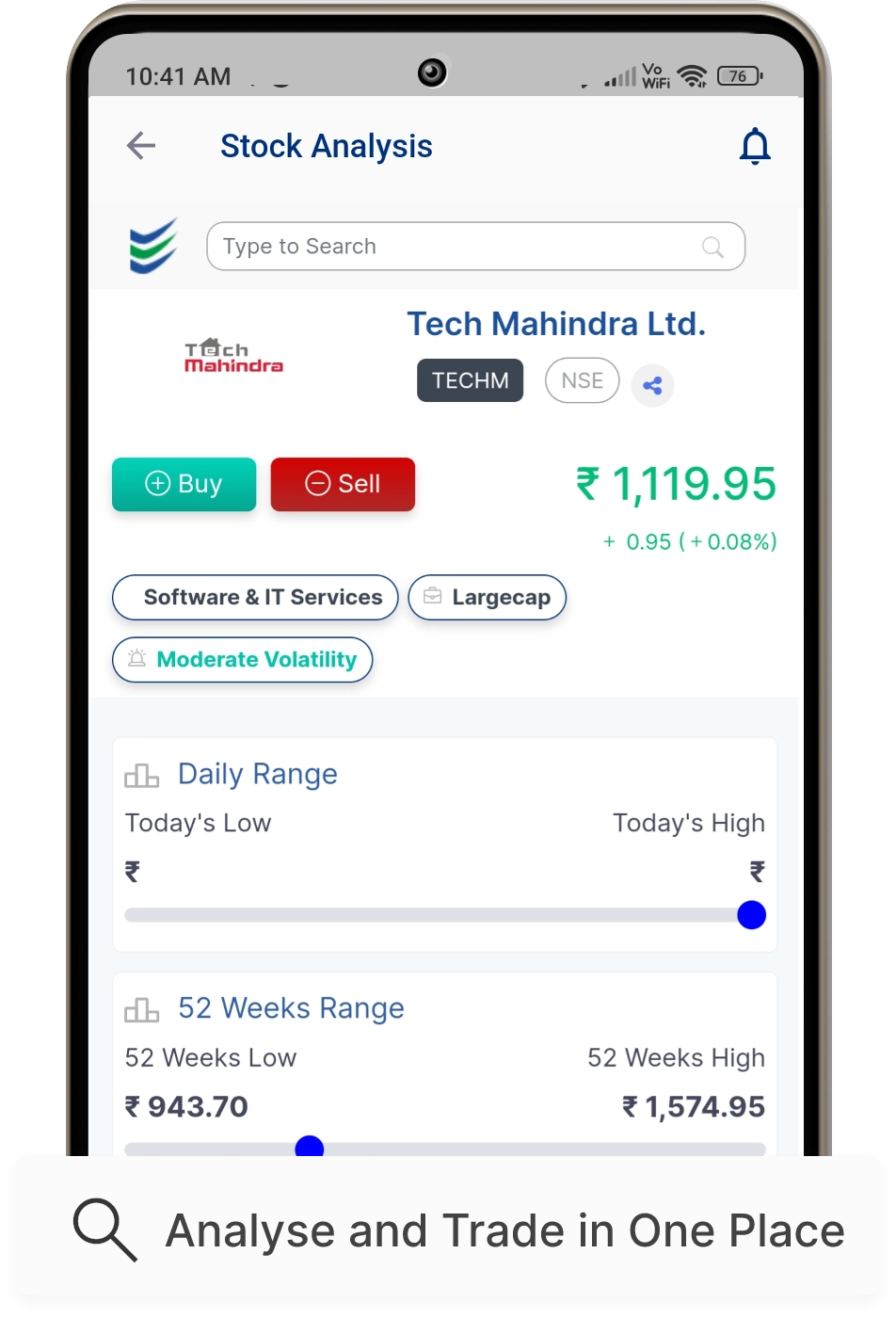

Predict the Stocks performance

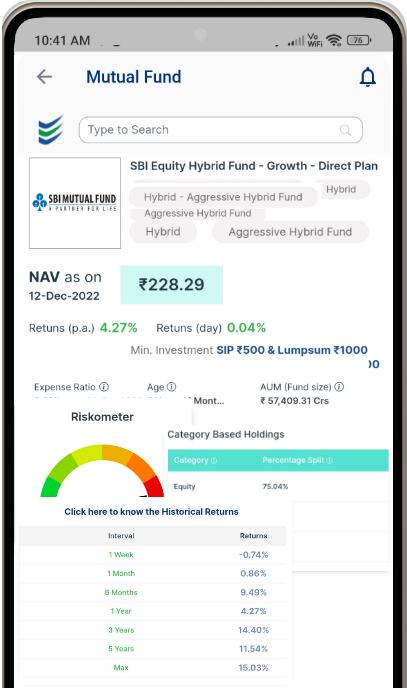

Analyse Mutual Funds

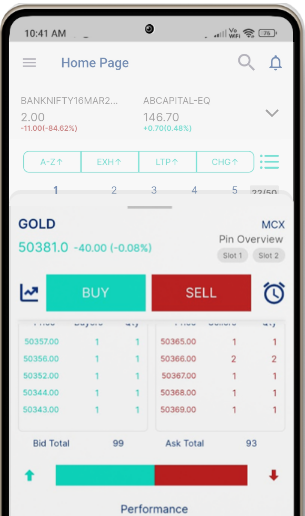

Trade Seamlessly

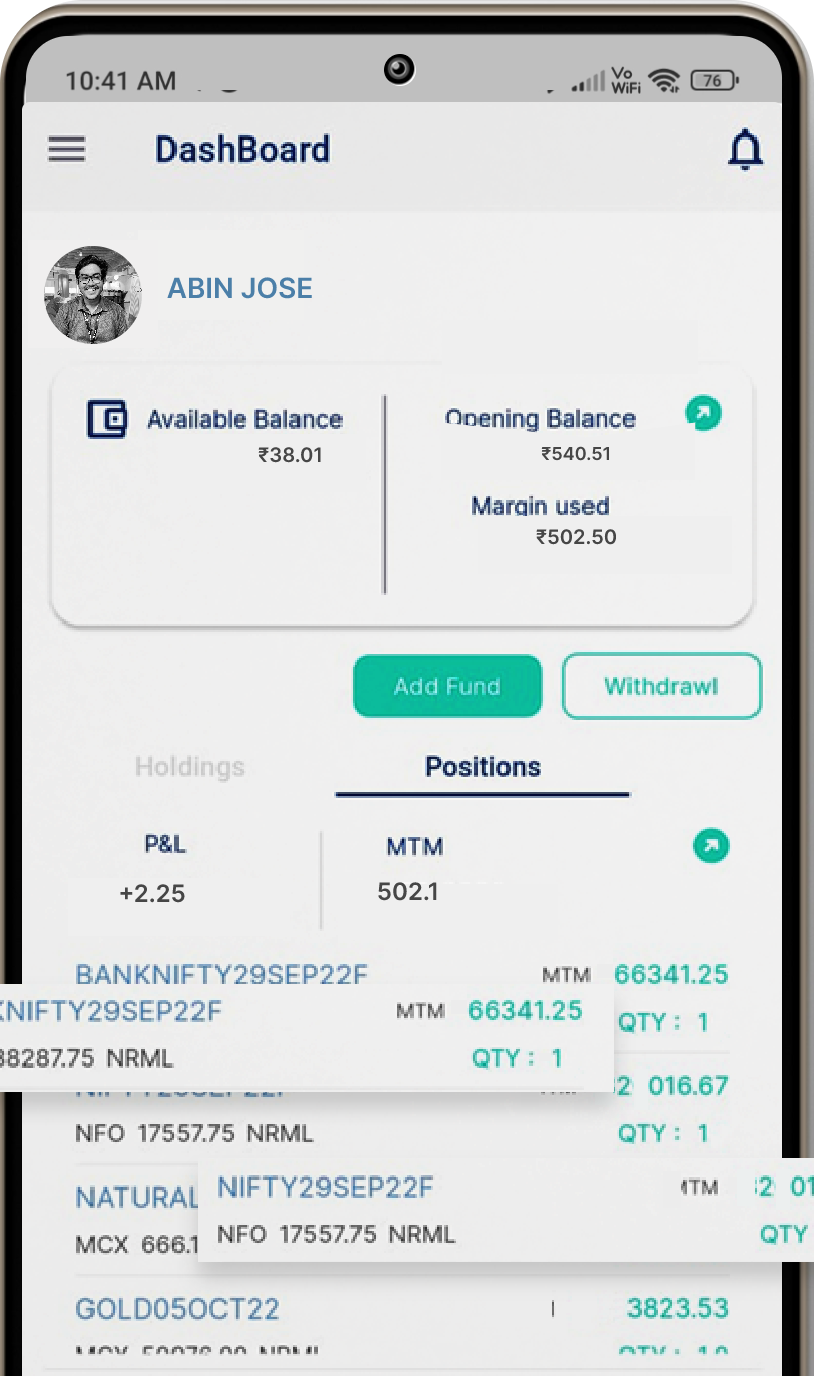

Track your Portfolio Easily

Why Choose Enrich Money

Easy Onboarding

Quick & secure onboarding process. Open Demat account in just 10 minutes

Transparency

Our process is completely transparent, and there are no hidden charges

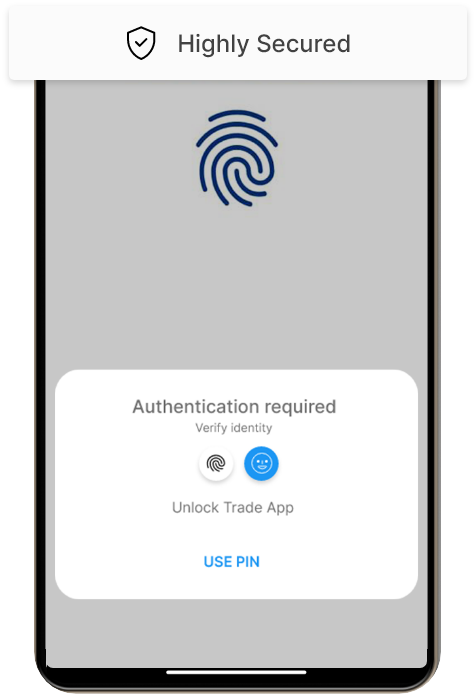

Highly Secured

Now trade with confidence with our high-level secured trading app

One Stop Financial Destination

Get all the necessary functions in one place for your trading or investing needs

Trading Made Simple

With our simplified design, place orders within seconds

Keeping up with Trends

With the new age technology, we made sure always stay ahead in the market.

How to Open a Demat Account With Enrich Money

Step 1

Fill up your information in the lead form

Step 2

Enter your otp to proceed further

Step 3

Fill up the fields to finish your KYC process

Step 4

You will recieve your Demat details by email

Step 5

Hurray! You all are set to begin your Trading/Investing

What We Offer For You

Namakkal, Tamilnadu

Kancheepuram , Tamilnadu

Bodhan , Telangana

Karnataka

Palani, Tamilnadu

Pathanamthitta , Kerala

Warangal, Telangana

Hyderabad, Andra Pradesh

Erode, Tamilnadu

Gunadal, Karnataka

Karnataka

Frequently Asked Questions (FAQ)

Demat accounts are electronic accounts that are used to hold and trade securities.

A Demat account offers convenience, safety and security, faster transactions, and easier tracking and monitoring of investments.

Yes, in India, it is compulsory to have a Demat account to trade or invest in securities such as stocks, bonds, and mutual funds.

The requirements for opening a Demat account in India are that, an individual must be a resident Indian, Non-Resident Indian (NRI), or a Person of Indian Origin (PIO).There is no minimum age requirement, in order to open a Demat account.

₹ 0 Account Opening Charges.

To open a Demat account, the following documents are generally required:

- Proof of identity (PAN card, Aadhaar card, Voter ID card, Passport, etc.)

- Proof of address (Aadhaar card, Voter ID card, Passport, utility bill, etc.)

- Passport size photographs

- Bank account details (cancelled cheque or bank statement)

Additional documents may be required based on the specific requirements of the Depository Participant (DP) or broker with whom the investor is opening the Demat account.

Yes, a Demat account is necessary while applying for an IPO (Initial Public Offering) in India. The shares allotted through an IPO are credited to the investor's Demat account.

Yes, it is possible to transfer a Demat account from one Depository Participant (DP) to another. This process is called "Demat account transfer" or "Demat account shifting."

Yes, an individual can open multiple Demat accounts with different Depository Participants (DPs). However, it is important to note that maintaining multiple Demat accounts can lead to higher fees and may not be necessary for most investors.

.svg)

.svg)

.svg)